AFBI analysis of dairy market prospects

However, market corrections quickly followed. The high milk prices stimulated global supply and, following withdrawal of China from the powder market and the Russian import ban, prices started to fall sharply, causing major challenges to industry profitability throughout 2015.

Dairy market projections and implications

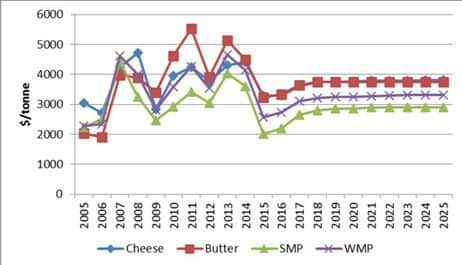

Provisional long-range projections produced by AFBI’s agricultural economists shed some light on likely future market developments. These projections are based on a global modelling system, taking into account supply and demand development across the world and specific assumptions about future oil prices, exchange rates etc. As shown in Figure 1, the provisional projections suggest that the prices of dairy products will show a limited recovery during 2016 and 2017, but it is unlikely that they will return to the highs of 2013/14. This is the result of a projected slowing down in global demand growth and at the same time production expansion from almost all the major producers (including the USA, Australia and the EU). In such a market climate, achieving greater market share in an already saturated EU market and/or opening up access to new markets will be necessary to achieve sectoral expansion as envisaged by the Agri-Food Strategy Board. Key strategies to compete in EU and global markets include being cost competitive, particularly in the bulk commodity market segment, and offering value-added products in the differentiated/niche market segment. For either strategy, productivity growth is key.

Productivity

Advertisement

Hide AdAdvertisement

Hide AdA recent OECD study investigated productivity growth in the dairy sector in three EU countries: England and Wales, the Netherlands and Estonia (Kimura and Sauer, 2015). It found little, if any, growth in productivity in the UK dairy sector over the past decade. While some productivity gains were achieved due to the exit of smaller farms, little progress had been made with regard to key productivity drivers including adoption of new technology and efficient management of inputs.

Going forward, in the competitive EU and international markets, improvements in production efficiency and productivity are vital at the farm level, and also in other stages of the supply chain. Improvements in production efficiency require attention to levels of milk output as well as the cost of production. Optimal production systems should be oriented towards profit rather than yield maximisation. Furthermore, systems should aim to be resilient in the face of volatile markets and prices. Benchmarking data collated by CAFRE on Northern Ireland dairy farms illustrate the considerable potential to improve financial performance through improved grassland management, silage quality and concentrate use efficiency. For example, cows should be turned out to grass as early as possible to maximise “litres from grass”, combined with optimal use of concentrate inputs. A rolling programme of pasture reseeding is recommended together with effective grazing management throughout the year.

The introduction of Business Development Groups as part of the new Rural Development Programme will provide an opportunity for group learning with the aim of identifying areas for improvement in production efficiency in individual businesses.