Retail investmentshowing recovery

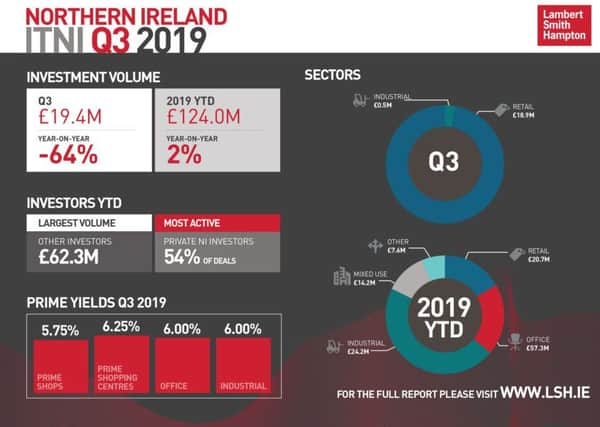

According to the latest Investment Transactions Northern Ireland Bulletin, published today by Lambert Smith Hampton, the deal took place early in Q4 providing a “significant boost” to the year end volume.

The bulletin also stated that retail dominated Q3 volume and this quarter saw transactions in the retail sector exceeding £1m for the first time this year.

Advertisement

Hide AdAdvertisement

Hide AdMeanwhile, the largest deal this quarter was Columbia Threadneedle’s sale of Clandeboye Retail Park in Bangor to Harry Corry Pension Fund for £8.7m.

The return of retail volume in Q3 was further boosted by Wetherspoon’s purchase of Revolución de Cuba in Belfast city centre for £3.3m.

Other high street investments also featured with private local investors purchasing 23-29 Queen Street in Belfast for £950,000 and 40-46 Bow Street in Lisburn for £850,000.

The only non-retail deal of Q3, was the purchase of City Business Park in Dunmurry for £479,000 by a private Northern Irish investor.

Advertisement

Hide AdAdvertisement

Hide AdAs usual, private Northern Irish investors continue to be the most active investor type. Over half of transactions this year involved a local purchaser and accounted for over a quarter of volume at £31.9m.

Q3 volume was not the expected return to form for the Northern Irish investment market.

Activity in the final quarter is expected to be “significantly stronger”.

Retail activity will dominate the latter half of 2019 and has the potential to retain its position as dominant asset class should Sprucefield Retail Park also be sold in Q4, breaking the dominant run of the office sector year to date.

Advertisement

Hide AdAdvertisement

Hide AdCity centre office investments remain the most in demand asset class due to the continued strength of the office occupier market.

The annual total for 2019 will exceed the £210m mark, exceeding both 2018 volume and the ten year annual average.

Over the past three years, the Northern Irish investment market has been slowed by a combination of local and national political uncertainty.

Demand for commercial property remains, however, sellers are delaying bringing assets to the market until there is clarity on the UK exit from the EU.

Advertisement

Hide AdAdvertisement

Hide AdMartin McCloy, director of capital markets, Lambert Smith Hampton, said: “Q3 volume was not the expected return to form for the Northern Irish investment market. Activity in the final quarter is expected to be significantly stronger with over £31m worth of deals already completed in the first three weeks of October, including the sale of Crescent Link Retail Park in the largest retail transaction since 2017, and over £30m of deals agreed. Retail activity is expected to dominate the latter half of 2019 and has the potential to retain its position as dominant asset class should Sprucefield Retail Park also be sold in Q4, breaking the dominant run of the office sector year to date. That said, city centre office investments remain the most in demand asset class due to the continued strength of the office occupier market. We expect that the annual total for 2019 will exceed the £210m mark exceeding both 2018 volume and the ten year annual average. The market is not in as poor a condition as activity may suggest.”