Northern Ireland economist Esmond Birnie backs Bank of England move to raise interest rates in bid to tackle soaring inflation

and live on Freeview channel 276

Dr Esmond Birnie, Senior Economist at Ulster University Business School, said the move would cost mortgage owners more but is also likely to aid savers.

He was speaking after the Bank of England pushed interest rates higher as it tries to put a lid on soaring prices. The bank's move came after UK inflation unexpectedly jumped higher last month.

Advertisement

Hide AdAdvertisement

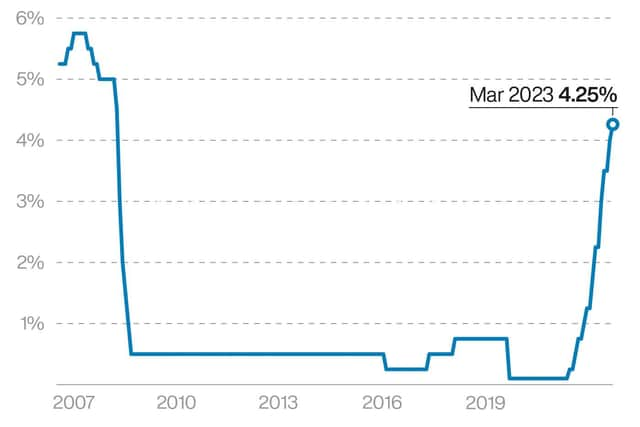

Hide AdPolicymakers on the Bank's Monetary Policy Committee (MPC) voted seven to two to increase rates from 4% to 4.25%, but said they expect the economy to grow slightly in the second quarter of the year, marking a reversal of the 0.4% decline in gross domestic product (GDP) the Bank had anticipated last month.

Inflation is set to come back down this year despite a surprise increase in Consumer Prices Index (CPI) inflation last month, to 10.4% from 10.1% in January, driven by surging food and drink prices.

Dr Birnie said the BoE had probably taken the right course of action.

“Notwithstanding the cost of living crisis and turbulence in the American and Continental European banking systems, the Bank of England’s Monetary Policy Committee was probably correct to decide on a further (0.25%) increase," he said.

He gave several reasons for his thinking;

Advertisement

Hide AdAdvertisement

Hide AdThe US Federal Reserve had just increased its rate (also by 0.25%), he noted, observing that worries about avoiding a slide in the value of the Pound compared to the Dollar tend to imply that UK interest rates track those in the USA.

Another reason, he said, was Wednesday’s news that the trend of dropping UK inflation rates had stopped.

"Today’s decision represents more pain for mortgage payers, particularly those on flexible rate mortgages or those re-negotiating a rate," he added.

"The monthly payment for a typical tracker mortgage in Northern Ireland could increase by about £15. The monthly payment on a typical Standard Variable Rate could increase by about £10. On the flip side, expect the increase in rates paid to savers to continue to rise”.

Advertisement

Hide AdAdvertisement

Hide AdIn a statement yesterday, the bank said: "The Consumer Price Index increased unexpectedly in the latest release, but it remains likely to fall sharply over the rest of the year."

It is the 11th time in a row the Bank has hiked interest rates.

The MPC recognised the recent period of volatility in the global banking sector, after the collapse of the US's Silicon Valley Bank and the rescue takeover of Credit Suisse, but stood firm in its mission to bring inflation back down to its 2% target.

"The economy has been subject to a sequence of very large and overlapping shocks," policymakers said.

Advertisement

Hide AdAdvertisement

Hide Ad"Monetary policy will ensure that, as the adjustment to these shocks continues, CPI inflation will return to the 2% target sustainably in the medium term."

The MPC said it would make a "full assessment" of recent banking woes and market volatility in its forecast in May, and that it was monitoring the situation closely.

There was also better news for the country's jobs market with employment growth in the second quarter likely to be stronger than expected, and a flat rather than rising unemployment rate.

The Chancellor's spring Budget earlier this month could increase GDP by about 0.3% over coming years, the Bank said.

The experts were also calmer about the outlook for household energy prices amid the Government's support scheme, with lower prices set to help bring down inflation by the end of the year.