Existing milk supply reductions will support milk price recovery

Northern Ireland

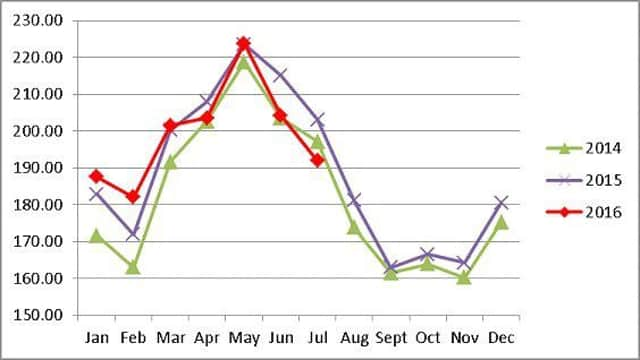

From April to July 2015 853.62 million litres of milk was produced in Northern Ireland according to DAERA data and the same period in 2016 saw 29.41 million less litres produced. This is significant considering this includes the traditional peak supply period.

The red line in Graph One (above right) illustrates Northern Ireland milk production in 2016 and shows a clear decline in production already in the system.

Advertisement

Hide AdAdvertisement

Hide AdIf milk production continues to fall at the current rate, it could see milk supplies in Northern Ireland falling back by 50 million litres from April to October 2016 even before the Voluntary Reduction scheme commences.

United Kingdom

From a wider UK perspective, the natural structural reduction in milk production is more pronounced.

AHDB last week indicated that dairy cull cow numbers for the period February to June 2016 have increased by 17% year-on-year. According to Ian Potter this translates to the equivalent of 310 million litres of milk being taken out of the system(even after taking replacements into consideration).

Dairy Consultants Kingshay have calculated that milk production from concentrates is also down by 310 million litres. This is often countered by a corresponding increase in feed-from-forage, but even when you factor this in (up 172 million litres), the milk yield from total feed is down 138 million litres. In addition to this, the BCMC have pointed to a lower proportion of cows in milk this year, hence a smaller milking herd and this could mean a further 109 million litre drop in volume.

Advertisement

Hide AdAdvertisement

Hide AdConsequently when all of these factors are combined, there could be 500 million litres coming out of the system naturally in the UK.

Time will tell as to any additional decrease in production through the Voluntary Reduction Scheme in the next three months, but the above figures indicate that a sizeable volume of milk has already left the system and will not be coming back and it is these falling volumes that are impacting upon the farmgate milk price.

EU Milk

Production Level

IFJ survey has shown that year-on-year milk production for September could be down between 3-10%. With Eurostat showing significant falls for France and Denmark as well as other Member States, it would appear that the structural reduction is already underway.

Oceania Milk Production

August 2016 milk supply data from Fonterra Australia show that Australian milk production down 12.3% year-on-year and in New Zealand, with peak production approaching, DCANZ figures show production down by 2.68% for the same period.

Conclusion

Advertisement

Hide AdAdvertisement

Hide AdIn conclusion, this article sets out the key drivers behind the reduction in milk supplies in the United Kingdom. The natural and structural reaction to low on-farm profits have been the driving force and these reductions will already be in the system. With milk supply reduction having reached a significant level already, this will create a sustained volume reduction which will help to shore up the recovery in farmgate milk prices.