Financial pressures intensify as demand rises for third sector

The Ulster Bank and CO3 3rd Sector Index is a barometer of Northern Ireland’s third sector, involving a quarterly survey of CO3 members who include the leaders of some of Northern Ireland’s largest charities and social enterprises.

Services they provide range from care, to counselling and support, and training and development.

Advertisement

Hide AdAdvertisement

Hide AdHowever, the latest report for the fourth quarter (Q4) of 2018 indicates that any glimmer of optimism recorded in Q3 concerning third sector organisations’ outlook for turnover expectations was short-lived.

Almost half (47%) expected turnover to increase in the 12 months ahead, falling to just 34% in the latest report.

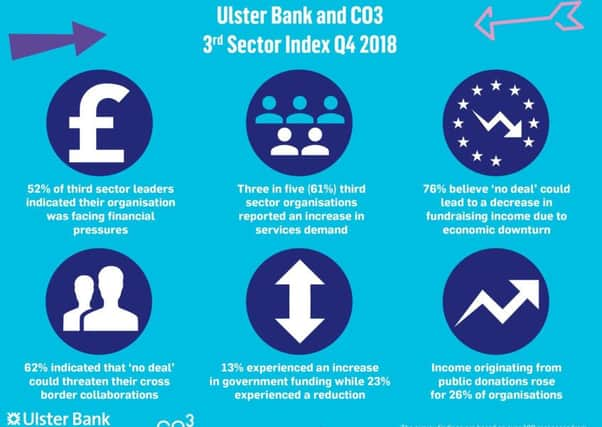

More than half (52%)of third sector leaders indicated their organisation was facing financial pressures, citing a variety of reasons including meeting staff salary rises.

Other sources of financial pressure included general overheads, pay settlements, redundancies and a downturn in funding or contracts.

Advertisement

Hide AdAdvertisement

Hide AdAt the same time the report says the sector has seen a 61% spike in demand for services.

Three quarters (76 per cent) described their organisation’s cash flow as “stable.” While 13 per cent experienced an increase in funding from government, almost one quarter (23 per cent) experienced a reduction.

Percentage of income originating from public donations rose in the last quarter of 2018 for 26% of third sector organisations, increasing by 12% on the previous quarter.

Specifically in relation to Brexit 76% believe a no-deal scenario may lead to a decrease in fundraising income due to economic downturn, and 62% fear a no-deal may threaten their cross-border collaborations.

Advertisement

Hide AdAdvertisement

Hide Ad“Last year was one of demand for the third sector,” said CO3 chiewf executive Nora Smith.

“It was demanding on services and financially demanding. As the pool of funding drained the sector continually adjusted to retain its vital services, without neglecting quality in the delivery of these services.”

Such uncertainty surrounding funding was creating an increasingly challenging environment for the sector to operate in, she said.

“The final quarter of 2018 was less than ideal for the sector. Outlook for the year ahead is likely to follow suit as economic and political expectations dwindle.”

Advertisement

Hide AdAdvertisement

Hide AdRichard Ramsey, chief economist for Northern Ireland at Ulster Bank, said the sector had once again seen a marked increase in demand for its services.

“Often, as the story of 2018 showed, this increased demand is accompanied by a reduction in public funding and strain on resources as a result – employment levels, retaining skilled employees, overheads. Two-and-a-half years after the referendum vote, with the “finish line” in sight, apprehension hasn’t receded either with mounting pessimism for Northern Ireland’s political and economic outlook.”