House price boom: home working and lockdown are helping to heat up NI’s property market

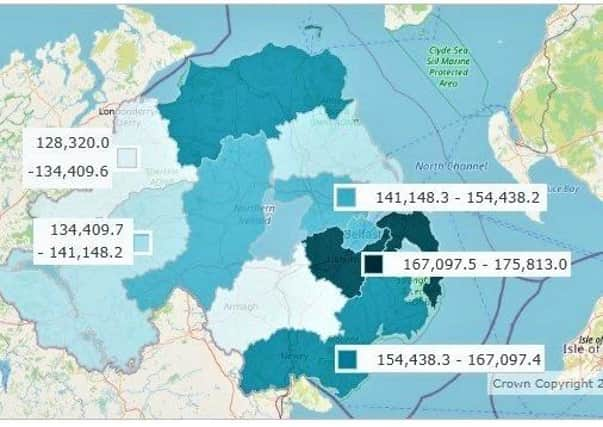

The surge in the number people seeking addition living space as seen the average house price in the Province rise by more that 8% between June 2020 and June 2021 – higher than any other region in the UK.

Overall, prices are still well short of 2007 boom levels —around 30% short — but are edging towards that sort of orbit again (see statistic below).

Advertisement

Hide AdAdvertisement

Hide AdLimavady estate agent Derek McAleese, pictured, said there are “more buyers than there are houses” at present.

The former Ulster and Ireland rugby star, who runs DMC estate agents, said: “Coastal locations, like Portstewart and Portrush, have gone a bit crazy, but the provincial towns are rising in price as well.

“I think it has to do with lifestyle, and people working from home. They are people just need that extra space. We warn our clients to expect a real flurry of activity over the first seven to ten days [of listing].”

Samuel Dickey, of Simon Brien residential and RICS residential spokesman, said: “We have sold to dozens of people who are from NI originally, lived in England and can now work from home, so they might sell a modest house in London for hundreds of thousands and come back and buy in a very good street in Belfast. They are pushing prices up everywhere.”

Advertisement

Hide AdAdvertisement

Hide AdMr Dickey added: “We don’t want to get into a situation again where there is a peak then a trough. Credit levels are still good, borrowing remains cheap. Prices in NI are still the lowest in the UK.”

Property expert Dr Martin McCord said the semi-detached and detached sectors are particularly buoyant, and added: “If we go into another lockdown, at least they’re in the comfort of a larger property”.

According to Dr Martin McCord, the Province’s property prices may also be ballooning faster than much of the rest of the UK because fewer new homes are being built here.

He was speaking after the property website Zoopla published data during the week, saying that Northern Ireland’s average house prices grew by 8.4% from June last year to June 2021.

However, different sources paint different pictures.

• Ben Lowry on last housing boom, link below

Advertisement

Hide AdAdvertisement

Hide AdBoth the NI Statistics and Research Agency (NISRA) and the UK-wide Office for National Statistics (ONS) state that from the first quarter of 2020 up to the first quarter of this year, Northern Ireland’s average prices only grew by 6%.

What is more, the ONS says Northern Ireland’s 6% was the second lowest growth of any UK region, with only London seeing a smaller rise (5.2%).

Ultimately, Dr McCord – a reader in real estate valuation and investment at Ulster University – said the differences could be down to the way these different organisations sampled their data.

As for his own view, he would be “not that surprised that any price inflation here is slightly higher than the rest of the UK”.

Advertisement

Hide AdAdvertisement

Hide AdThis is due to a long-standing “demand and supply imbalance” – in other words, Northern Ireland just isn’t building enough houses to satisfy the population.

“We don’t have enough sizeable development happening at the minute, whereas the mainland does,” he said.

Dr McCord is currently producing a report on the housing market, to be published on August 9, and expects it will show that from Q2 in 2020 to Q2 in 2021, there has been a roughly 9% rise in prices across Northern Ireland.

Before the Covid crisis struck, there were already “signs of the market actually heating up”, and since the end of the first lockdown “things have galvanised”.

Advertisement

Hide AdAdvertisement

Hide AdHe said that the “psychological effect” of that lockdown “made people realise they wanted to change their lifestyle choices”.

Fundamentally this meant getting a bigger house, and so “the semi-detached and detached sectors have certainly seen a sizeable increase in terms of transaction volumes.

The market therefore is driven by this “re-evaluation of lifestyle choice and options – plus the ability now where there’s more flexibility for working-from-home”, meaning people need a free “functioning room” to use as an office.

As a result, instead of the usual “timewasters”, there has been an upsurge in “firm bids” for homes.

Advertisement

Hide AdAdvertisement

Hide AdAnd with bank loans readily available, “in the short term there doesn’t look like there’s going to be any slowing just yet” in house price rises.

However, the market still has “a long way to go” before it gets back to the same levels as 2007, before the credit crunch and recession hit.

Estate agent Derek McAleese said many clients seeking larger properties have complained of high stress levels during the Covid restrictions, and are paying top prices for the right family home.

“With kids there for a year-and-a-half, maybe crammed up in the house, without a computer room or maybe a second living room and parents working from home, everybody was going a wee bit nuts,” he said.

Advertisement

Hide AdAdvertisement

Hide Ad“The prices... will probably level out, but I don’t think they will fall back. So we have noticed a rise in prices which we weren’t expecting.

“Certainly here in Limavady there are more buyers than there are houses so it’s a very good time to sell.”

According to the Land Registry, house prices in Northern Ireland peaked at £224,670 in the third quarter (summer) of 2007, fell 57% to their lowest point of £97,428 in the first quarter (winter) of 2013, and had risen by more than half to £149,178 in the first quarter of this year.

However, they have risen since then and have probably now recovered to 70% of peak levels.

Advertisement

Hide AdAdvertisement

Hide Ad• Ben Lowry: The last Northern Ireland housing boom was disaster, and we need to beware a repeat of it

More news:

——— ———

A message from the Editor:

Advertisement

Hide AdAdvertisement

Hide AdThank you for reading this story on our website. While I have your attention, I also have an important request to make of you.

With the coronavirus lockdown having a major impact on many of our advertisers — and consequently the revenue we receive — we are more reliant than ever on you taking out a digital subscription.

Subscribe to newsletter.co.uk and enjoy unlimited access to the best Northern Ireland and UK news and information online and on our app. With a digital subscription, you can read more than 5 articles, see fewer ads, enjoy faster load times, and get access to exclusive newsletters and content. Visit https://www.newsletter.co.uk/subscriptions now to sign up.

Our journalism costs money and we rely on advertising, print and digital revenues to help to support them. By supporting us, we are able to support you in providing trusted, fact-checked content for this website.