Start Up Loans milestone with more than £14.5million worth of loans issued to over 1,600 Northern Ireland firms

and live on Freeview channel 276

Start Up Loans, part of the British Business Bank, has delivered more than £1billion of loans across the UK since its inception in 2012 – with more than £14.5m worth of loans issued to over 1,600 Northern Ireland firms.

A government-backed personal loan scheme, A Start Up Loans are available to individuals looking to start or grow a business in the UK. In addition to finance, successful applicants receive 12 months of free mentoring and access to resources to help them succeed.

Advertisement

Hide AdAdvertisement

Hide AdIn Northern Ireland the scheme has delivered 1,647 loans to new business owners at an average of £8,825 per loan.

The Start Up Loans programme also provides a means of reaching under-represented groups who are excluded from mainstream finance by helping them start businesses.

Of the £14.5m, £5.4m (37%) has been leant to female business owners in Northern Ireland via 618 loans and £603,737 (4%) has been leant to people from black, asian and other ethnic minority backgrounds (not including white minorities).

Just 4% of the UK’s small businesses in 2021 were majority-led by people from an ethnic minority group and only 20% of new businesses had female founders according to The Rose Review.

Advertisement

Hide AdAdvertisement

Hide AdYoung people in Northern Ireland between 18-24 years old have received more than £1.6m (11%) in loans since the programme began, however the most popular age range for loans here was 31-49 with more than 800 loans made totalling just over £8.1m.

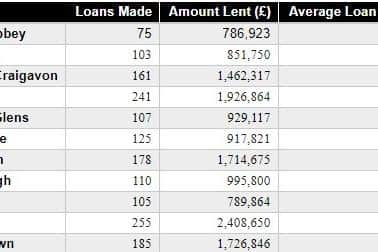

In Northern Ireland the council area with the most loans was Mid Ulster with 255 loans valued at more than £2.4m (average loan being £9,446), followed by Belfast with 241 loans totalling more than £1.9m (average loan being £7,995). Where as Antrim & Newtownabbey received the lowest amount of loans with 75 valued at £786,923 (however the average loan was the largest in the province at £10,480).

One recent Start Up Loans recipient was Omagh entrepreneur Sarah-Jane Murray. Sarah-Jane took out a loan of £10,000 to help fulfil her dream of launching sustainable activewear business, Vocus Vit.

Vocus Vit offers premium activewear for ladies with a focus on sustainability. The range is made from recycled plastic bottles without compromising on comfort, fit and style.

Advertisement

Hide AdAdvertisement

Hide AdSarah-Jane Murray, said: “One of my biggest challenges was cashflow and I needed a loan to help me get set up. I remember thinking there is no way I was going to get a loan, but I applied to the British Business Bank’s Start Up Loans programme and I was successful in getting a £10,000 loan.”

Since taking the loan, Sarah-Jane hasn’t looked back and would encourage anyone with the ambition of starting their own business to see out similar opportunities to invest in their future.

She explained: “One of the big benefits of this loan has been the flexibility and another benefit has been the mentoring you receive. I have learnt about profit and loss forecasts and social media marketing which, for someone new to business, has been invaluable.”

Susan Nightingale, UK Network director for the devolved nations, British Business Bank, continued: “We are delighted the Start Up Loans programme has delivered more than £1bn worth of loans across the UK and more than £14.5 million in Northern Ireland.

Advertisement

Hide AdAdvertisement

Hide Ad“We have always been committed to providing support and funding to smaller businesses across Northern Ireland, with entrepreneurial ambitions across all industry sectors.

“The delivery of over £14.5m in loans to Northern Ireland entrepreneurs highlights our continued efforts to help people achieve their business goals.”

Small Business Minister Kevin Hollinrake, added: “Across the UK, thousands of small businesses have now been supported by over a billion pounds in Start Up Loans.

“This crucial support is enabling enterprising companies like Vocus Vit start and scale up their ventures and I urge even more to follow in their footsteps.”

The Start Up Loans programme has been shown to be value for money to the UK taxpayer, with an independent review showing the economic benefits of the scheme are 5.7 times the economic cost.