UK business activity drops as firms feel pressure with Northern Ireland 'at the bottom of the list', says Ulster Bank

and live on Freeview channel 276

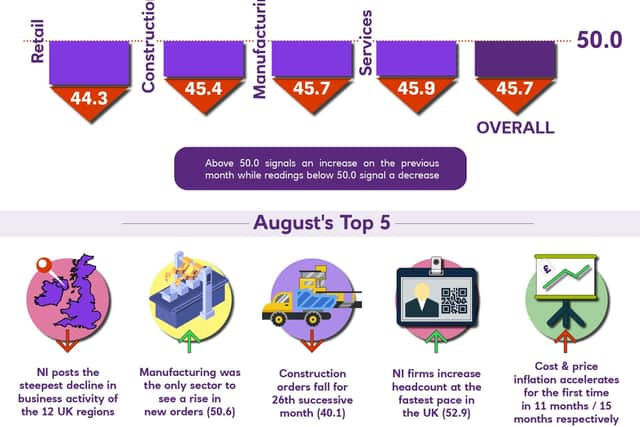

The fall was the sharpest since January and, although reflective of a wider unease across the rest of the UK, Northern Ireland was ‘at the bottom of the list’ of all 12 regions.

Each of the four broad sectors, retail, construction, manufacturing and services, covered by the survey saw activity decrease.

Advertisement

Hide AdAdvertisement

Hide AdAccording to the survey, rising costs were reportedly behind the reduction in output, and also led new orders to decrease. New business was also down solidly, and for the third month running.

Every month the bank asks firms across the economy about things like staffing levels, order books and export activity.

However on a more positive note, firms continued to take on additional staff.

Commenting on the latest survey findings, Richard Ramsey, chief economist Northern Ireland, Ulster Bank, said: "Like the weather, private sector performance in most of the UK regions took a turn for the worse during August. Indeed, only two UK regions recorded growth in output last month. And Northern Ireland is at the bottom of the list, with the sharpest rates of decline seen across the UK.

Advertisement

Hide AdAdvertisement

Hide Ad"There were some positive aspects of the Northern Ireland survey, including the UK’s fastest rate of employment growth, and the ongoing normalisation of supply chains, with faster delivery times benefiting local firms. In addition, despite ongoing challenges, firms outside of the construction industry are expecting a pick-up in activity in 12 months’ time, meaning that sentiment continues to be relatively healthy.

"However, these positives are outweighed by a weakening in demand and a pick-up in inflationary pressures. Business activity in Northern Ireland fell for the second month running, with output recording its fastest rate of decline in seven months and all four sectors posting a decline in August.

"Inflationary pressures had been easing over the past 12 months or so, but faster rates of input cost inflation – which respondents attributed to higher wages - and output price inflation were reported in the latest survey. This is still well below the elevated inflation rates seen during the past three years, but is perhaps a warning to businesses that they can’t be complacent about cost pressures.

"This survey relates to the deteriorating conditions in the private sector. However, the challenges we are seeing in the public sector at a national level, not least the emerging signs of years of underinvestment, are worrying. This is also a feature in Northern Ireland but addressing these challenges is complicated by the ongoing absence of an Executive and the mounting fiscal challenges this is creating."

Advertisement

Hide AdAdvertisement

Hide AdThe headline seasonally adjusted Business Activity Index dropped to 45.7 in August from 48.2 in July, below the 50.0 no-change mark for the second month running to signal a drop in output in Northern Ireland's private sector.

Finally, although the pace of input cost inflation ticked up in the latest survey period, it remained relatively muted compared to the trend over the past three years. Higher wages were the principal cause of the rise in input prices. Output charges meanwhile increased at a marked pace. New product launches are predicted to lead to a rise in output over the coming year, with sentiment remaining relatively healthy in August. That said, confidence dipped from that seen in July.