US report drives protein markets

Soya is leading the charge as the USDA reduced its forecast for Argentina’s soyabean crop by 2.5m tonnes to 56.5m tonnes, contributing to a drop in global production. Meanwhile China, the world’s biggest soyabean consumer, is set to import a record 87m tonnes of soyabeans in the coming year, up 4m annually, largely to feed its growing livestock and poultry sector.

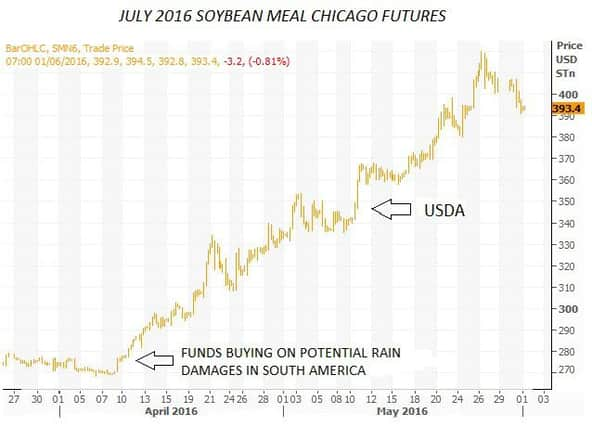

Contracts for July soybeans rose by the maximum daily limit of 65 cents, or 6.3 per cent in Chicago trading on the back of the new USDA estimates of grain supply and demand for the coming season.

Advertisement

Hide AdAdvertisement

Hide AdThese reports are closely followed by the trade and have a big influence on the market sentiment.

The price for nearby soyabean meal futures was also strong – hitting the highest level since September 2014 while other commodities were pulled along in its wake.

This is the first report since dry weather in Brazil and flooding in Argentina damaged the soyabean and corn crops under cultivation in South America and restored volatility to grain markets.

Predictions are that customers will turn to the US to source beans and revitalize the export trade which had been hurt by the strong dollar in recent months. Weather concerns are also keeping an edge to the market in this region however amid fears of a La Nina weather event which would increase the possibility of hot and dry weather during the critical flowering stage of the current US crop and potentially impact yields in South America next spring.

Advertisement

Hide AdAdvertisement

Hide AdThe outlook for grain remains bearish as bumper crops of maize and wheat are predicted as spring growing conditions are favourable in most of the key exporting regions. In spite of the likelihood of record global grain stocks the Chicago futures posted higher prices for both wheat and maize.

The implications for global protein prices are alarming as the other principle proteins such as rapemeal are being forced higher as buyers look for alternatives. In reality there is no substitute for soya in many diets and it highlights the vulnerability of our local livestock sector.

Pig and poultry producers are dependent on these imports from North and South America to maintain productivity and are at the mercy of one of the world’s most volatile supply chains.