UK 'is now nearing a 1970s price spiral' says Ulster University economist as Bank of England hikes up lending rate once again

and live on Freeview channel 276

He made the comments as the Bank of England hiked up the “bank rate” for the 13th consecutive quarter on Thursday, from 4.5% to 5%.

But Dr Birnie said while this will deepen the financial hole that some families are in, it is a “cruel necessity” for the long-term good.

Advertisement

Hide AdAdvertisement

Hide AdThis echoes chancellor Jeremy Hunt who said: “If we don’t act now, it will be worse later.”

The bank rate is basically like the base level at which UK banks lend money; where the Bank of England leads, private banks and building societies generally follow.

The bank usually hikes or lowers the rate by 0.25%, but has opted for a jump of double that.

As the Bank of England puts it, a higher rate “tends to discourage businesses from taking out loans to finance investment, and to encourage people to save rather than spend – as a result, there is less demand for goods and people spend less”.

Advertisement

Hide AdAdvertisement

Hide AdThe idea is that this can suppress inflation because “people overall will spend less on goods and services [so] the economy slows down and companies can’t put up their prices so quickly”.

Inflation (according to the RPI index) has stayed below 5% basically ever since the start of the 1990s.

In 2022 it began spiking and is now at over 8%.

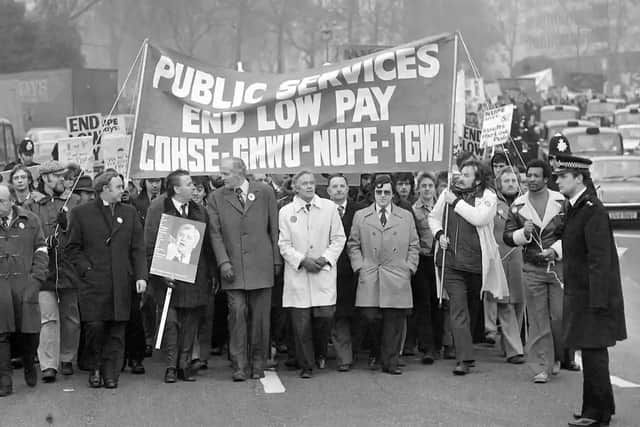

But this is still way below the extremes of the 1970s, when inflation hit almost 25% during the middle of the decade as unions demanded higher wages to chase the rising prices.

Dr Birnie, senior economist at Ulster University’s business school, said: “The economic context made yet another Bank of England Rates rise almost inevitable.

Advertisement

Hide AdAdvertisement

Hide Ad"Perhaps the only real question for debate was whether the bank would opt for a limited 0.25% increase or a more forthright 0.5%. Now we know the answer.

"This notwithstanding the very severe effect on the disposable income of many households.

"As of Wednesday the Institute for Fiscal Studies was estimating that average mortgage monthly repayments in Northern Ireland had already gone up by about £150 compared to March 2022.

"The negative shock will be especially severe for those who come off a fixed rate mortgage and have to agree a new one at a much higher interest rate.

Advertisement

Hide AdAdvertisement

Hide Ad"That said, the Bank’s Monetary Policy Committee had little option but to tighten the monetary screws.

"UK consumer inflation rates in May were 8.7%, the same as in April. Whilst inflation appears to be dampening down in other Western economies there is much less sign of that in the UK.

"Indeed, the UK labour market appears to be running at very high temperatures with private sector wages growing at 7.6% in the year to April (and 5.6% growth in the public sector).

"The UK appears to be dangerously close to developing a 1970s style wage-price spiral.

Advertisement

Hide AdAdvertisement

Hide Ad"We might wish that things were different but they are what they are.

"Monetary policy, be it painful, has to be driven by theory and data and not a therapeutic consideration of what might make people feel better in the short run because short term gain is usually bought at the cost of long term pain”.