MI Northern Ireland Market Report

Brexit uncertainty was the predominant driver of domestic markets last week. The change in value of the pound lead to the appearance of divergent wheat market behaviour. Paris and Chicago wheat futures were little changed over the week in their respective currencies (Friday – Friday), while UK feed wheat futures gained.

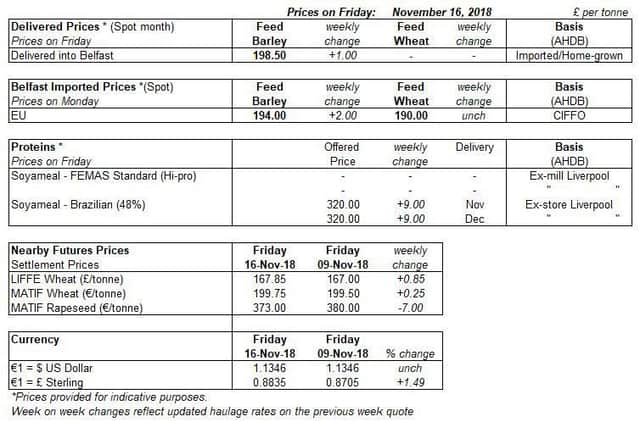

Brexit once again dominated the headlines last week. Following a rise in the pound after the draft deal announcement, a succession of resignations in the Conservative government caused the pound to fall 1.5% from Friday 9th November to Friday 16th November, and pushed UK feed wheat (May-19) up £2.00/t across the week (Friday-Friday).

Advertisement

Hide AdAdvertisement

Hide AdGlobal oilseeds saw mixed movement this week, with future trade speculation and currency the key drivers. The value of Chicago soyabeans climbed last week, after comments from the US president diffused market fears of an upcoming escalation of the trade dispute with China. Paris rapeseed futures fell last week, while UK delivered rapeseed prices rose. These changes were largely due to volatility of currency, where the pound weakened 1.5% against the Euro.

Comments from US president Donald Trump regarding a possible easing of the US-China trade dispute brought a lift to Chicago soyabean futures (Reuters). Markets responded to the US president hinting that further proposed tariffs on China may not be necessary, as China would like a deal. The US and Chinese leaders are expected to meet at the G20 summit at the end of the month.

Planting of the anticipated 17.9Mha Argentine soyabean crop was at 21.7% as of 14 November, down slightly (2.1%) from the same period last year (BAGE). Heavy rainfall across Argentina last week was reported to have hampered soyabean planting in regions worst affected. With some areas likely requiring replanting, any additional rain could cause further delays.