MI Northern Ireland Market Report

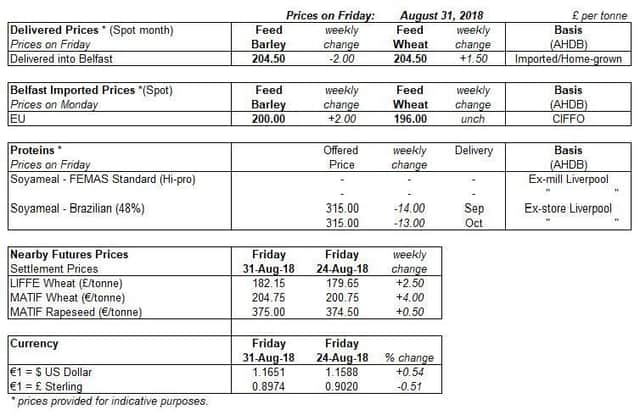

Overall, global grain markets gained last week (Friday-Friday), in part due to speculation about export curbs. UK feed wheat futures (Nov-18) also climbed during the week, gaining support from the mid-week global rise. Closing up £2.50/t on the week, UK wheat futures (Nov-18) reversed some of the previous two weeks losses.

The area of cereals grown in Northern Ireland decreased by 3% to 31.3Kha in 2018 according to the June agricultural census (DAERA). The cereal area is now the lowest in records back to 1981 when the cereal planted area was almost double that of 2018. With a declining Northern Ireland cereal area, imports will likely rise in 2018/19 (read more here).

Advertisement

Hide AdAdvertisement

Hide AdDry conditions are forecast to persist through the Australian spring, according to the latest outlook by the Australian Bureau of Meteorology. The International Grains Council (IGC) last week pegged Australian wheat output down 3% from 2017, whilst barley and rapeseed fell 4% and 24% respectively.

Despite falling mid-week, Paris rapeseed futures ended last week largely unchanged in euro and sterling terms. Prices were initially pulled lower by the soyabean market, but recovered in the latter part of the week as further concerns emerged about global rapeseed supplies. US soyabean prices fell through the week under pressure from expectations for a large US crop and a stronger US dollar.

Canadian canola (rapeseed) production was pegged 10% lower than 2017 at 19.2Mt on Friday by Statistics Canada. If confirmed, a smaller Canadian crop could further tighten global rapeseed supplies, which is likely to further reduce the influence of soyabean prices on rapeseed prices in future.

EU-28 rapeseed production was reduced again by both the EU Commission and private analysts Strategie Grains due to the adverse weather in the growing season. The Commission cut its forecast by 0.5Mt compared to those made in late-July to 19.2Mt, now over 12% lower than 2017/18. Meanwhile, Strategie Grains cut its estimate of the 2018 crop from 20.0Mt to 19.6Mt. This further tightens EU supplies and is forecast to increase the EU’s oilseed import requirements in 2018/19.