MI Northern Ireland Market Report

Grain markets in the US fell sharply early last week after rain arrived on Monday. The rain was short-lived and prices rose on consecutive days.

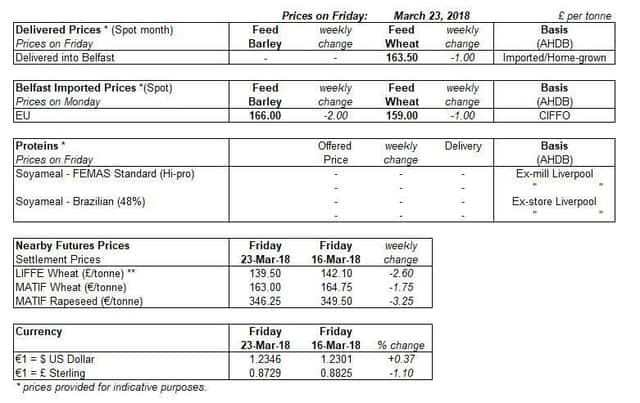

Meanwhile in Europe, Paris wheat futures declined last week (Friday-Friday) in part due to the US rain and the euro strengthening against the dollar. London feed wheat futures also saw declines last week (Friday-Friday), also influenced by the US weather and strengthened Sterling against the dollar. However, UK delivered wheat prices (as at Thursday 22) were more mixed partially due to local demand and on farm priorities also a factor.

Advertisement

Hide AdAdvertisement

Hide AdRain relief arrived briefly for wheat in the US plains last Monday causing US wheat futures to fall sharply. The rain was only short-lived however, with dry condition returning and consequently prices firming in the following days. US crop reports released yesterday (26th March) showed that the rain had improved the condition of Kansas wheat, with the proportion of crops rated poor and very poor declining from 55% to 49%. However, this is still well above 2017 levels.

Initial projections for 2018/19 grain stocks indicate that the situation will be tighter than 2017/18. Total grain ending stocks were projected down 8% to 560Mt globally in 2018/19 by an initial release in the International Grains Council (IGC). This global decline is largely driven by a projected decline in world maize stocks of 42Mt to 265Mt, despite increased production, with higher demand expected for maize. Meanwhile wheat production is expected to decline by 17Mt, with ending stocks falling by 3Mt.

Weather was again the main driver for oilseed markets last week (Friday-Friday). The arrival of rain in drought stricken regions of Argentina resulted in soyabean prices falling sharply at the start of the week. However, prices tracked sideways in the rest of the week following scepticism towards the scope of the positive impact the rains on the Argentinian soyabean crop. Paris rapeseed futures and UK delivered rapeseed prices also mirrored this trend.

The recent cold snap across Europe has had a limited impact on winter crops according to the March crops bulletin from the European Commission. Cold conditions in France, the EU’s largest producer of rapeseed, caused leaves to have frozen unevenly. The impact of this is uncertain at this stage, with potential for the crop to compensate for this damage later in the season.