Poll: How much would Irish unity cost – and what flag would be flown?

The opinion poll involved London-based firm Kantar, and the results were published in Ireland’s Sunday Independent.

And writing in the Sunday Independent Colm McCarthy, a Dublin economist who formerly worked for the Irish Central Bank, sounded a note of caution about how re-unification played out for West Germany, which ended up subsidising its poorer East German territories.

Advertisement

Hide AdAdvertisement

Hide AdThe survey asked if people would be willing to pay more tax to fund re-unification.

In Northern Ireland 64% said they would oppose such higher taxes, and so would 54% of respondents in the republic.

Mr McCarthy wrote that “there will be no reunification without economic consequences, including budgetary consequences”.

He said: “Thirty years have elapsed since the reunification of Germany, a project accomplished without conflict, and which saw East Germany absorbed with no serious dissent into its more prosperous neighbour.

Advertisement

Hide AdAdvertisement

Hide Ad“There was no serious opposition in West Germany to reunification... despite the economic and financial burden expected to follow.

“A unity referendum in the Republic would not be so straightforward.

“If opinion in Northern Ireland ever shifts towards reunification, the economic and financial consequences will come vividly to public attention in the Republic

“There is a parallel to the position in West Germany 30 years ago, where voters faced a solidarity tax, a surcharge initially of 7.5% on top of personal income tax and some business taxes, to make up for the budget gap in the East.

Advertisement

Hide AdAdvertisement

Hide Ad“The tax has been eased substantially but has still not been finally eliminated for all voters, 30 years down the road.”

He said that to cope with the costs of supporting Northern Ireland’s absorption into a wider republic, it may be necessary to “raise the basic income tax rate from 20% to around 28%” for example.

He concluded: “Figures may look different if ever a unity poll arises, but they will not be pretty.”

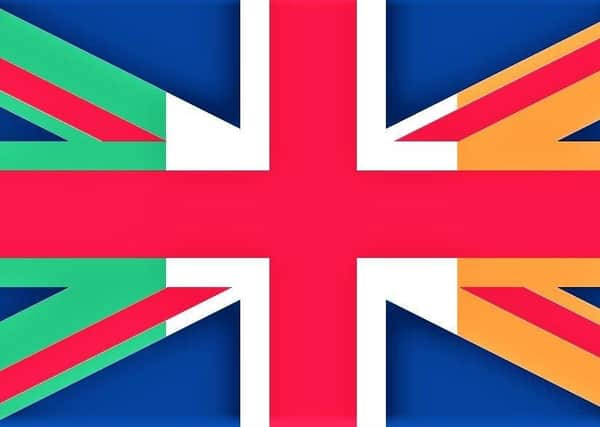

Respondents were also asked questions about the flag of any new unified state: “If there was a hypothetical united Ireland, symbolism will be important. In terms of flags, what would be your preferred option?”

Advertisement

Hide AdAdvertisement

Hide AdBy far the most popular response was this one: “Create a new flag that recognises both traditions.”

It was supported by 46% of Northern Irish respondents, and 37% of respondents in the republic.

Only 15% of Northern Irish respondents would want the tricolour alone to be flown everywhere on the island – rising to 36% for respondents in the republic.

Advertisement

Hide AdAdvertisement

Hide Ad——— ———

A message from the Editor:

Thank you for reading this story on our website. While I have your attention, I also have an important request to make of you.

Advertisement

Hide AdAdvertisement

Hide AdWith the coronavirus lockdown having a major impact on many of our advertisers — and consequently the revenue we receive — we are more reliant than ever on you taking out a digital subscription.

Subscribe to newsletter.co.uk and enjoy unlimited access to the best Northern Ireland and UK news and information online and on our app. With a digital subscription, you can read more than 5 articles, see fewer ads, enjoy faster load times, and get access to exclusive newsletters and content. Visit https://www.newsletter.co.uk/subscriptions now to sign up.

Our journalism costs money and we rely on advertising, print and digital revenues to help to support them. By supporting us, we are able to support you in providing trusted, fact-checked content for this website.

Alistair Bushe

Editor