Northern Ireland construction workloads continue to fall, but at slowest rate in two years

and live on Freeview channel 276

Construction workloads in Northern Ireland continued to fall through the last quarter of 2023, but they did so at the slowest rate since early 2022, according to the latest Royal Institution of Chartered Surveyors (RICS) Construction Monitor.

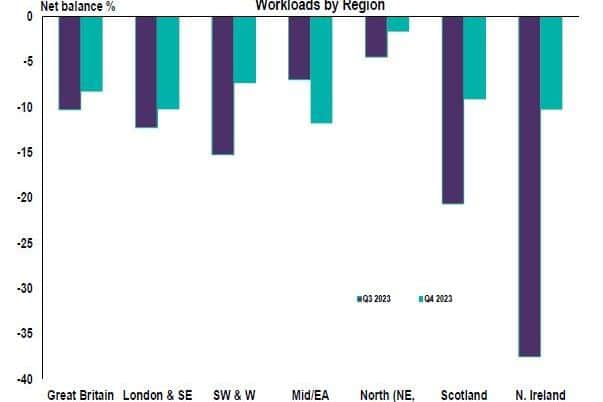

A net balance of -10% of respondents in NI reported a fall in workloads, up from -38% the quarter previous. Whilst NI still sits below the UK average, which was reported to have fallen flat, the NI workload balance is now more in line with the UK average than it has been seen in several years.

Advertisement

Hide AdAdvertisement

Hide AdLooking at the subsectors, NI surveyors reported that workloads in public housing (-10%), private housing (-15%), private commercial (-22%) and private industrial (-26%) all fell. However, whilst they remain in negative territory, they were all less negative than in Q3 2023. ‘Other public works’ was the only subsector that saw a rise in workloads, with a net balance of 28% of NI respondents reporting an increase. Infrastructure workloads were reported to have fallen flat.

Looking ahead, Northern Ireland respondents expect workloads to fall over the next 12 months with a net balance of -5% expecting a decline, up from -7% in Q3. Surveyors in NI are less optimistic than respondents in the rest of the UK where a net balance of 12% expect a rise in workloads over the next year on average.

NI respondents also indicate that profit margins will continue to be squeezed in the same timeframe, albeit it is the least negative reading for this indictor since the beginning of 2022. A net balance of -15% of NI respondents expect profit margins to fall, compared to -45% that expected a fall in Q3.

Surveyors in NI continue to note a shortage in labour. Looking at construction professionals, 48% of respondents reported a shortage, 46% noted a shortage in bricklayers, and 52% of respondents reported a shortage in quantity surveyors. They also expect employment levels in the industry to continuing increasing over the next 12 months, despite squeezed workloads.

Advertisement

Hide AdAdvertisement

Hide AdAnecdotally, respondents cite the absence of a Northern Ireland Executive as a key factor behind falling workloads.

Jim Sammon, RICS NI Construction spokesman, said: “2023 was certainly a turbulent year for the construction industry in Northern Ireland, with rising costs, other economic challenges, and declines in workloads, all mixed with the challenge of political uncertainty.

"In the final quarter of 2023, the vast majority of other UK regions saw increases in infrastructure workloads, but this is not a trend we are seeing in Northern Ireland.

"The move to restore devolution is welcome in this respect, as it will bring additional resources which can help us deal with some of the challenges in the construction sector and, as importantly, unlock decision-making that can support decarbonisation and policy change to deliver a more sustainable built and natural environment.”